Introducing Cafe Corazon at the cofipass Rewards Launch Party during SXSW 2024 in Austin, Texas

Tuesday, March 26nd, 2024

Official photos from the event can be found here, thanks to Parker George.

A few weeks back during SXSW 2024, we hosted the cofipass Rewards Launch Party at the cofipass HQ in East Austin. Introducing our latest Rewards Partner, Cafe Corazon, cofipass brought in over 200+ new users to sign-up and check-in using our web-app. Our event featured upcoming artist Dj Thani, a South Asian DJ focused on global sounds and hip-hop, and a variety of local brands across canned water, beer, ad pre-biotic sodas. Thank you to our brand partners We want to thank our brand partners for making this event a success:

- Cafe Corazon - our latest Rewards partner located at 1701 E Martin Luther King Jr Blvd #103, Austin, TX 78702

- Luna Espresso - mobile espresso/coffee cart catering service

- Sightseer Coffee - women-owned coffee roaster serving international blends

- Poppi - pre-biotic "modern soda for the next generation" sold nationwide

- Rambler - limestone filtered Texas-based water sold nationwide

- Central District Brewing - small-batch brewery with a community taproom

- Blue Owl - distinctive East Austin brewery specializing in sours

- Dj Thani - South Asian DJ focused on global sounds and hip-hop

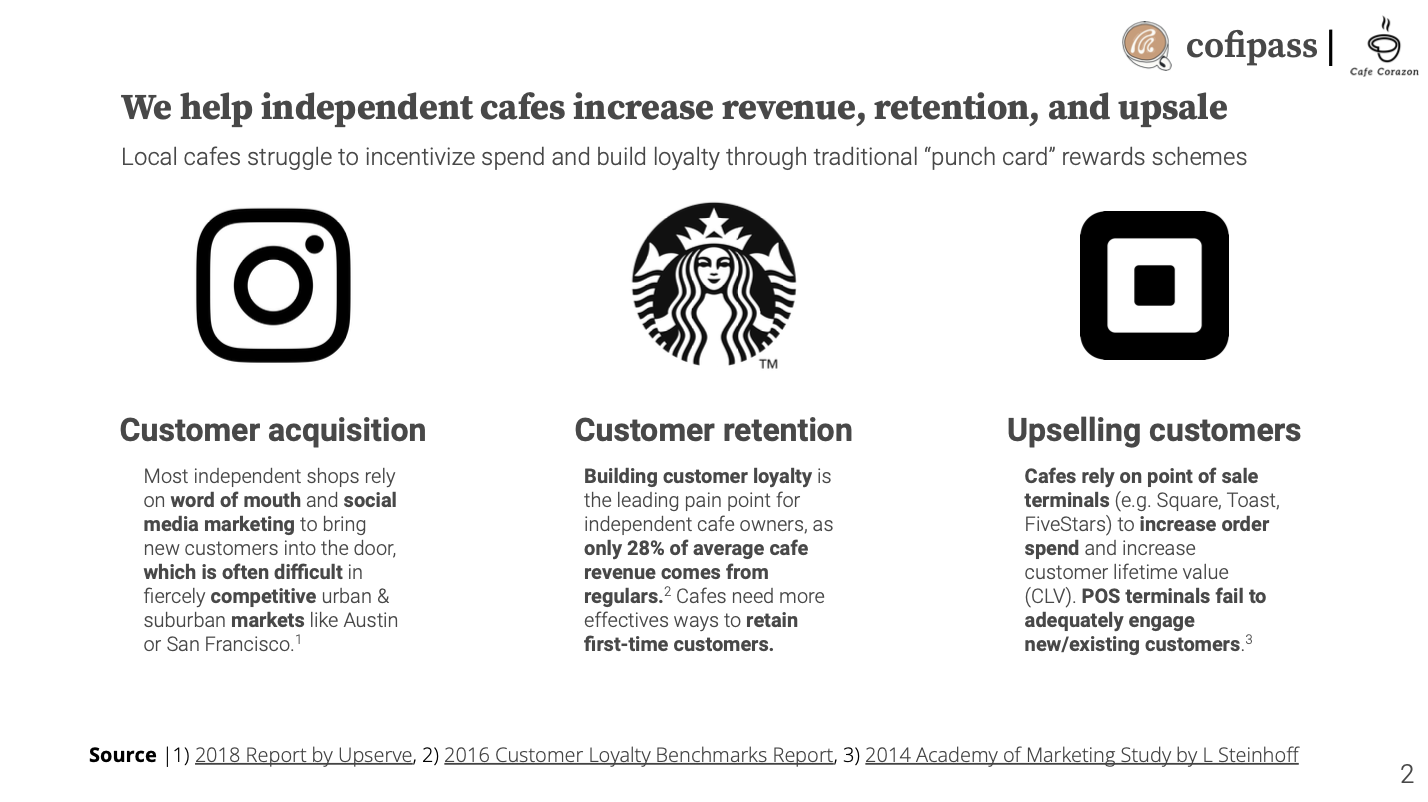

Introducing cofipass Rewards

cofipass Rewards provides independents shops with a vertically integrated loyalty and rewards program that enables SMBs (small to medium size businesses) to achieve three main business objectives:

- Customer attraction - bringing new customers and existing customers to spend money at a shop

- Customer retention - enabling consistent spend across multiple transactions to maximize CLV (customer lifetime value)

- Customer upselling - boosting average transaction volume when customers spend at the POS terminal

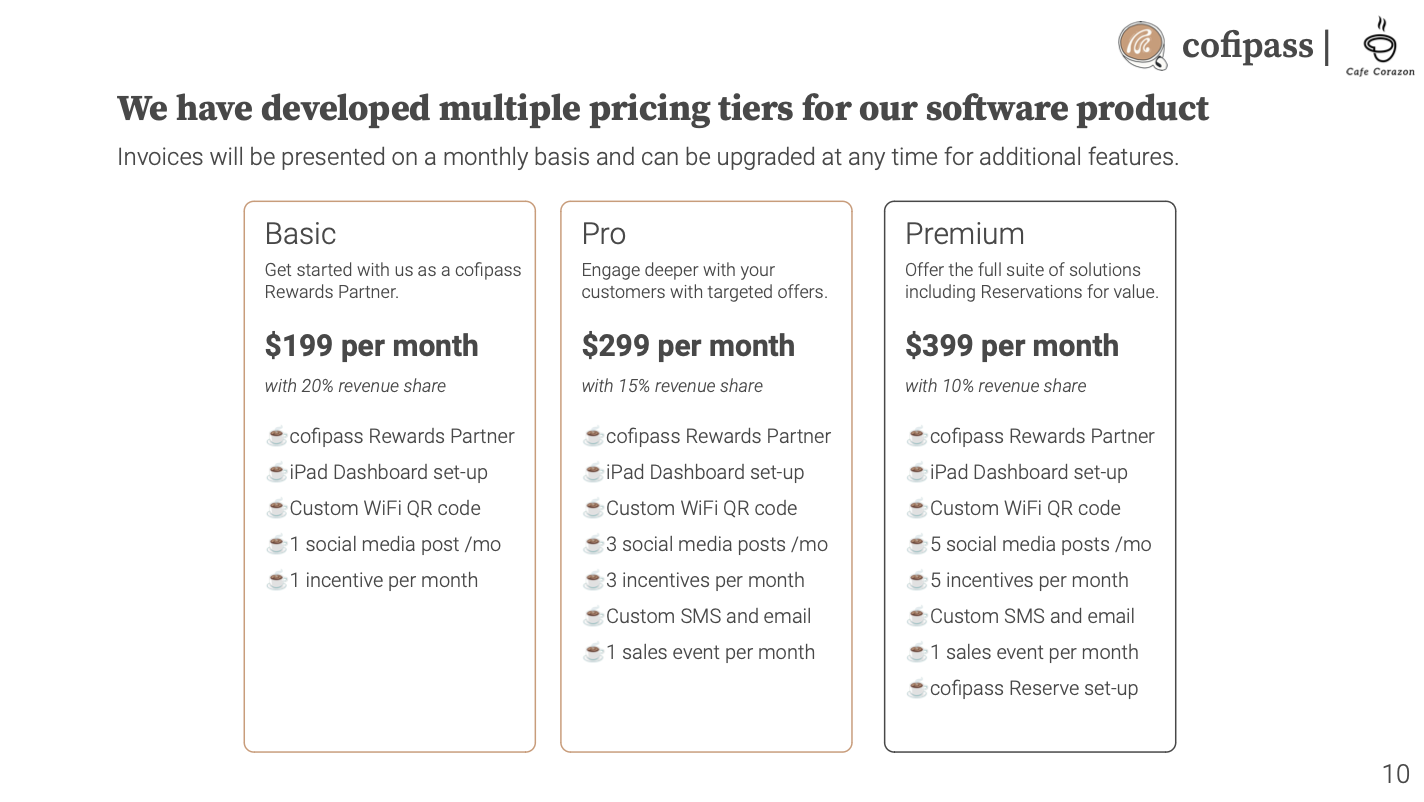

Pricing our software product

In exchange for access to our software infrastructure, we have begun offering various price-points for our services on a monthly basis. We've offered three tiers of service, with a hybrid pricing model the combines both a monthly subscription fee and a revenue-sharing agreement.

While pricing is subject to evolve, we've found that our shop partners are more than willing to pay a monthly fee in exchange for access to a suite of tools that bring the shop more money. In order to built trust with cafes, we evaluate each pricing agreement on a case by case basis to ensure we are actively assessing the value-added for each our partners, who represent a unique customer base and approach to craft coffee. We want to stress that we are first and foremost striving to be a consumer marketplace, so the revenue-sharing component of our pricing is meant to align our business objectives with the independent shop owner. By keeping our skin in the game, we show shops that we are focused on both bringing in new users daily while also ensuring that they are spending on a more recurring basis. Some of our partners have actually suggested a higher monthly price point in exchange for a lower revenue-share, to provider a greater incentive to onboard existing loyal customer bases to cofipass (e.g. the shop owner may not want to route existing loyal customers to cofipass if it means giving up 20% of revenue). Our evolving pricing strategy represents broader trends within "Software-as-a-Service" companies, where merely serving as a "utility" SaaS tool is not enough of a sell for new businesses to pay an indefinite monthly subscription fee. Businesses and customers both want to assess a concrete financial incentive at the onset of signing up, underscoring the importance of revenue-sharing.

Reducing points of friction on both sides

Getting the chance to spend over 12+ months on product development since our initial launch has taught us an immense amount regarding what users want with any consumer product or platform: seamless user experiences.

For instance, our user onboarding was previously functional yet cumbersome. The vast majority of new users took over 1 minute to sign-up, which is way too much time in a society where users are more fickle than ever when it comes to trying new things or signing up for novel product experiences. We resolved some points of friction by adding mobile number authentication. With apps like Partiful that conduct that so much of their product experiences "out of the box," mobile number authentication has made things easier for all parties. Still considered a "two factor" authentication method, mobile number authentication allows users to sign-up and onboard without ever leaving the application with the help of auto-complete on iPhone and Android via SMS data extraction.

Layering adjacent to the POS terminal

Perhaps one of the biggest topics of conversation among investors is determining our ability to seamlessly integrate with the existing payments infrastructure of our partner cafes. Most POS terminals used by cafes (e.g. Square, Clover, Toast, Fivestars) indeed have developer facing APIs to encourage interoperability, but often become much more difficult to integrate bespoke software products. There are broader concerns with POS terminals distributing transaction data for individual customers, especially when customers haven't opted in or consented to the distribution of such data. cofipass seeks to bypass the POS terminal instead, by building our software dashboard product on a separate iPad to ensure that we control the flow of transaction data. While our software involves a few additional steps during the node of the transaction, we have the comfort that we can onboard additional shop partners while actively integrating on our cafe dashboard software to reduce points of friction. Namely, our next goal is to release unique QR codes are associated with each cofipass user to further automate the "check-in" process to ensure an even more seamless transaction experience.

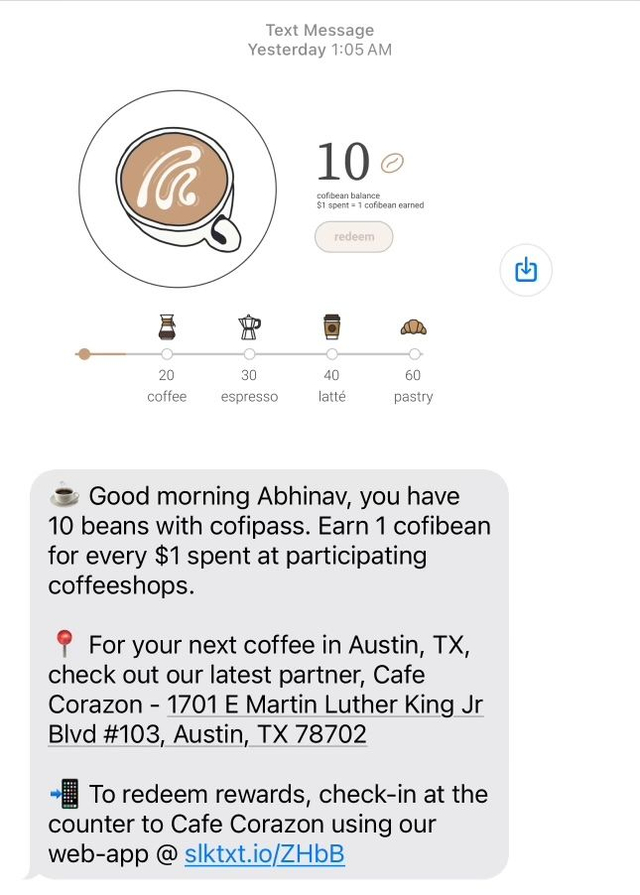

Exploring customer engagement methods

One next step for us at cofipass is building a stronger customer engagement pipeline. Over the last two years, we have avoided persistent contact with customers in the past to prevent churn as we iterated on our product experience and brand identity.

Now that we have garnered a salient user base of over 500+ unique engaged users and 300+ shops in our search engine, it is on us to nurture our user base to keep them engaged. On the right, you can see our first ever official SMS rewards marketing campaign blast with Cafe Corazon. We have defined our ideal conversion as a new user spending money at a partner cafe. We hope to learn from our incentive experiments in the coming months to better craft the demand base for our shop partners.

Doubling down on the consumer brand

As we continue to build cofipass, we are spending more time studying the successes of our well-known consumer brands like Uber, AirBnB, Lyft, VRBO, Starbucks, and Sephora, to ensure we are doing the most we can to boost organic growth and power the cofipass marketplace. Historically, it seems that it takes the power of a strong marketing campaign to really spark the interest of the right user base. We're hoping to focus this summer on building a robust student ambassador program to target students at the University of Texas at Austin and surrounding schools. We will also pay close attention to modern content mediums like TikTok and Instagram capture the right trends that will resonate well with our youg and cost-conscious customer base.

Getting involved with cofipass

If you are an investor, designer, or engineer, we would love to chat. Please don't hesitate to find time on my calendar here.

If you are a student at a university or college and want to learn more about our upcoming student ambassador program, please write me a note at abhinav@cofipass.com with some initial information about yourself and the school you are studying at.

And of course, if you are looking for a work-friendly coffeeshop, click the button!

Start grinding.

abhinav sridharan

founder & ceo

cofipass

get work done.

Copyright © 2021 cofipass, LLC. All rights reserved.